Picture this: A young couple walks into a car dealership, excited to purchase their first vehicle. They’re brimming with anticipation, but financing is a concern. Enter Angle Auto Finance, a company that bridges the gap between dreams and reality by providing tailored auto loan solutions. With its innovative approach, Angle Auto Finance has emerged as a leader in the automotive financing industry. But how does this translate into revenue? Let’s explore the financial backbone of this organization.

The Business Model Driving Revenue

How Angle Auto Finance Generates Income

Angle Auto Finance operates primarily through partnerships with car dealerships and direct-to-consumer channels. Here’s a breakdown of their revenue streams:

- Interest Income: The company earns interest on loans issued to customers. Interest rates are typically determined based on the borrower’s credit score, loan amount, and repayment terms.

- Dealer Partnerships: Angle Auto Finance collaborates with dealerships to offer financing solutions. In return, dealerships pay a commission for every successfully financed deal.

- Service Fees: Customers may incur additional fees such as loan origination fees, late payment fees, and early payoff penalties.

- Insurance and Add-On Products: By offering extended warranties, GAP insurance, and other value-added products, Angle Auto Finance taps into ancillary revenue streams.

Key Financial Metrics

Annual Revenue Growth

Over the past five years, Angle Auto Finance has experienced steady revenue growth. According to industry reports, the company’s revenue grew by 15% year-over-year (YoY) in 2023, reaching an estimated $850 million.

Loan Portfolio Performance

The quality of a loan portfolio directly impacts revenue. In 2023:

- Average Loan Amount: $25,000

- Default Rate: 1.8% (below the industry average of 2.3%)

- Repayment Rate: 96%

These metrics reflect the company’s robust underwriting standards and effective risk management practices.

Industry Trends Impacting Revenue

The Rise of EV Financing

As the automotive industry transitions towards electric vehicles (EVs), financing needs are evolving. Angle Auto Finance has capitalized on this trend by introducing specialized EV loan products with lower interest rates and longer repayment periods. According to a report by IBISWorld, the EV market is projected to grow at a 22% compound annual growth rate (CAGR) by 2030, opening new revenue opportunities for financing companies.

Digital Transformation

The adoption of digital tools has revolutionized auto financing. Angle Auto Finance’s online application platform has reduced operational costs and increased customer acquisition. The platform’s AI-driven credit scoring system ensures faster approvals, enhancing customer satisfaction and boosting revenue.

Rising Interest Rates

The Federal Reserve’s interest rate hikes have a dual effect on Angle Auto Finance. While higher rates increase interest income, they also pose a risk of reduced borrowing. However, the company’s competitive rates and flexible terms help mitigate this challenge.

Competitive Analysis

Positioning in the Auto Finance Market

Angle Auto Finance faces competition from both traditional banks and emerging fintech companies. However, it distinguishes itself through:

- Customer-Centric Approach: Personalized loan solutions tailored to individual needs.

- Technology Integration: A seamless digital experience that simplifies the financing process.

- Strong Dealer Network: Partnerships with over 10,000 dealerships nationwide.

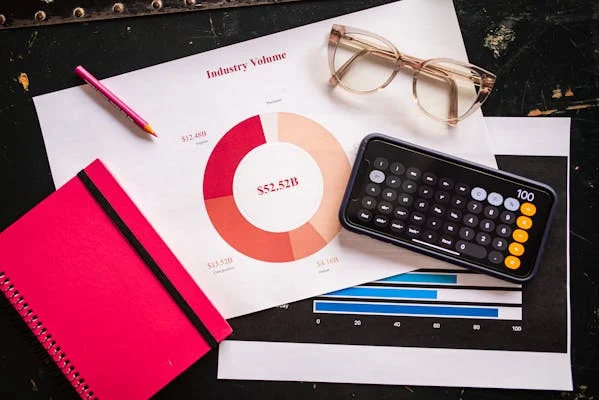

Market Share

In 2023, Angle Auto Finance held an 8% market share in the U.S. auto finance industry, making it one of the top five players in the sector.

Challenges and Risks

Economic Downturns

Economic recessions can lead to higher default rates, impacting revenue. Angle Auto Finance mitigates this risk through diversified loan portfolios and stringent credit checks.

Regulatory Compliance

The auto finance industry is heavily regulated. Non-compliance with federal and state laws can result in hefty fines. The company invests significantly in compliance training and auditing to avoid such pitfalls

Strategies for Revenue Growth

Expansion into New Markets

Angle Auto Finance plans to expand its operations into emerging markets, such as Latin America and Southeast Asia, where auto ownership is on the rise. These regions present significant growth potential due to increasing disposable incomes and urbanization.

Enhancing Customer Retention

Loyal customers are key to sustained revenue. The company aims to improve retention through:

- Loyalty programs offering lower rates for repeat customers.

- Regular customer engagement via email and app notifications.

Innovation in Loan Products

The introduction of flexible payment plans, such as income-based repayment options, can attract a broader customer base and drive revenue.

Conclusion

Angle Auto Finance’s revenue is a testament to its strategic vision and customer-first philosophy. By leveraging technology, adapting to industry trends, and maintaining a strong focus on compliance, the company has positioned itself as a leader in the auto financing space. As it continues to innovate and expand, what new heights can Angle Auto Finance achieve in the coming years?