In today’s fast-paced financial markets, finding the right trading strategy can make all the difference between success and failure. Among the various opportunities available, one term gaining attention is trade 1000 urex. Whether you are a beginner or an experienced trader, understanding how to navigate this opportunity is essential for maximizing returns and minimizing risks. This guide will explore everything you need to know about trade 1000 urex, from its basic concepts to advanced strategies.

What is Trade 1000 Urex?

Before diving into techniques and strategies, it is crucial to understand what trade 1000 urex really means. Essentially, it refers to trading contracts based on a platform or model associated with 1000 units of a Urex-based financial instrument. Urex is often linked with innovative market solutions, focusing on offering traders more flexible and scalable trading opportunities. The “1000” typically denotes the volume or size of the trading unit, giving investors significant leverage and exposure to market movements.

The appeal of trade 1000 urex lies in its scalability, allowing both small and large investors to participate without needing a massive upfront investment. Traders can manage their portfolios more effectively, and with the right skills, they can use this instrument to diversify and enhance their financial outcomes.

Why Choose Trade 1000 Urex?

Choosing to trade 1000 urex offers numerous benefits that appeal to a wide variety of investors. First, it allows traders to gain exposure to different assets without holding them physically, thereby reducing storage and management costs. It also offers enhanced liquidity, meaning you can enter and exit positions with greater ease compared to many traditional investments.

Another major advantage is the potential for high returns. With proper risk management, traders can leverage small price movements into substantial profits. The flexible structure of trade 1000 urex means that it fits different trading styles, from day trading to long-term investing, thus catering to a broader audience. Furthermore, the technology backing urex trading platforms typically emphasizes speed and reliability, essential qualities in today’s electronic trading environment.

How to Get Started with Trade 1000 Urex

Starting your journey with trade 1000 urex involves a few critical steps. First, you need to select a reputable trading platform that supports urex trading. Make sure the platform offers robust security features, competitive fees, and comprehensive educational resources. Once you have chosen your platform, the next step is setting up your account, verifying your identity, and funding it with the necessary capital.

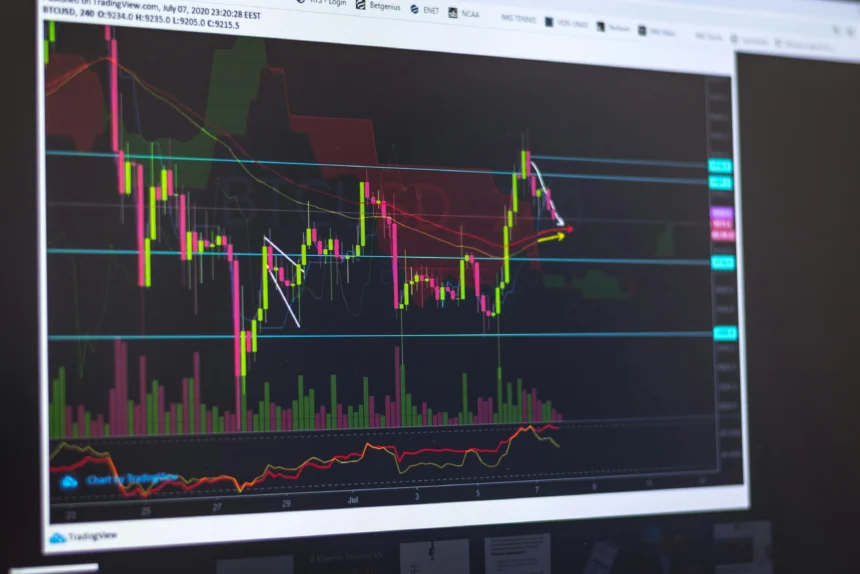

Educating yourself is paramount before placing your first trade. Spend time understanding market indicators, trading charts, and common market behaviors. Practicing with a demo account can be invaluable, offering a risk-free environment to refine your skills. After gaining confidence, you can begin live trading, starting with smaller positions to manage risk effectively.

Strategies for Successful Trading

When engaging in trade 1000 urex, employing effective strategies can significantly impact your success. One popular method is trend following, where traders look for established market directions and ride the trend for profits. Identifying these trends involves analyzing moving averages, support and resistance levels, and momentum indicators. Another effective strategy is swing trading. This approach involves capturing short- to medium-term gains over a few days to several weeks. Swing traders use technical analysis to identify trading opportunities and often capitalize on market volatility.

Risk management cannot be overstated. Always set stop-loss orders to protect against significant downturns, and never risk more than a small percentage of your trading capital on a single trade. The key to long-term success with trade 1000 urex lies in maintaining discipline, managing emotions, and sticking to a well-developed trading plan.

Understanding the Risks

While the potential rewards of trade 1000 urex are enticing, it is equally important to recognize the risks. Market volatility can work against you as easily as it can work for you. Rapid price changes can result in significant losses if trades are not properly managed.

Leverage, while increasing potential returns, also magnifies losses. It is crucial to use leverage wisely and understand the terms set by your trading platform. Overconfidence is another pitfall; even seasoned traders can make poor decisions if they become complacent or driven by emotions. Continuous learning and adapting to market conditions are essential to mitigate risks. Monitoring economic news, understanding geopolitical developments, and staying updated with industry trends can help you anticipate market movements and adjust your strategies accordingly.

Final Thoughts on Trade 1000 Urex

In the evolving landscape of financial trading, the opportunity to trade 1000 urex offers both promising rewards and considerable challenges. By thoroughly understanding how it works, employing effective strategies, and practicing disciplined risk management, traders can navigate this opportunity successfully. Trade 1000 urex stands out for its flexibility, scalability, and potential for high returns, but it demands a solid foundation of knowledge and a commitment to continuous learning. The world of trading is not static; it evolves constantly, and those who adapt have the best chance of long-term success. If you are considering diving into this exciting opportunity, are you ready to master the skills and strategies needed to succeed in the world of trade 1000 urex?